↓ Get a data overview with our Green Consumer infographic

↓ Download this article (PDF)

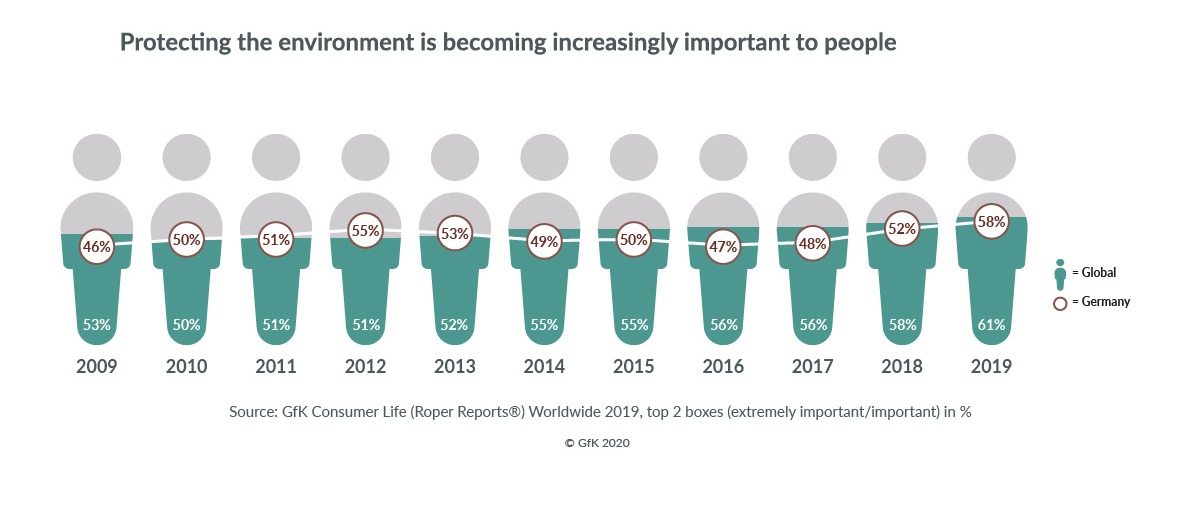

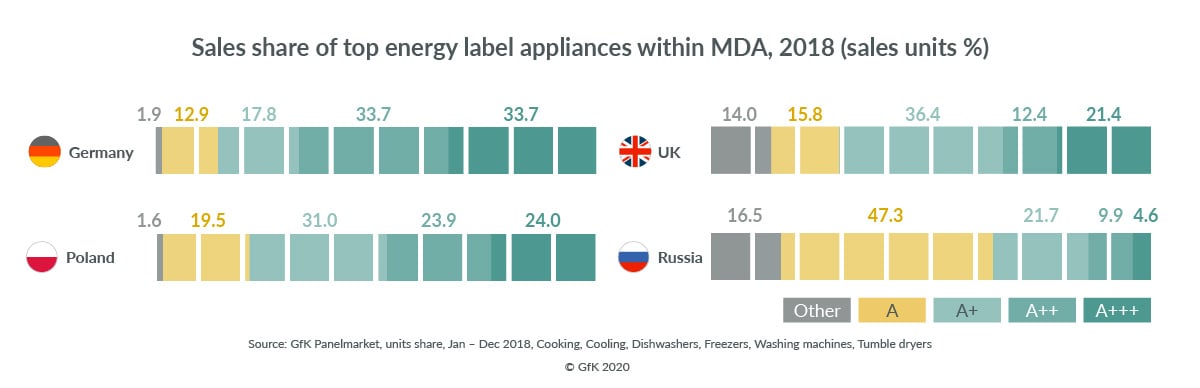

In 2021, the EU will introduce “rescaled” labelling for energy-efficient appliances – replacing the current A+++, A++, A+ etc ratings that provide very little differentiation among top bandings, with more specific A-G ratings. This will give consumers clearer distinction at the point of sale between the top-rated appliances, alongside new labelling around repairability and durability – also key environmental credentials. For consumers, protecting the environment is increasingly top of mind too – especially so across Europe, where we are tracking the highest concentrations of consumers impacted by the eco-conscious trend.

Crucially, this demand is translating into purchasing trends too.

Across Europe’s EU10 markets, we are tracking a continuing massive increase in purchases of the top-rated energy labels within major domestic appliances. The share of washing machines, tumble dryers, fridges, freezers and cooking appliances bearing the top two highest energy labels has jumped from 24% of total units sold in 2012, to 62% in 2018. [Read more about MDA and clashing consumer trends around energy efficiency]

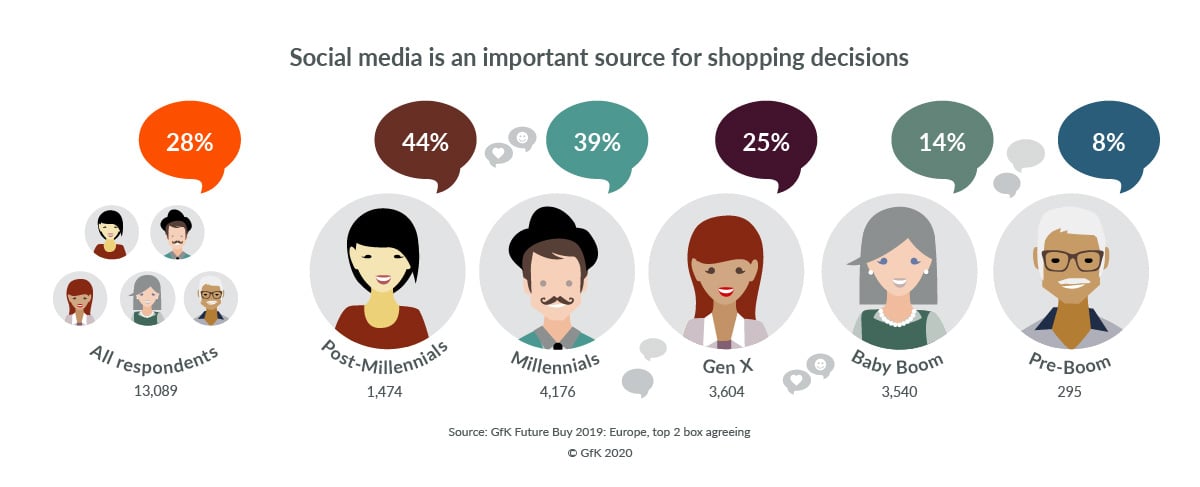

An interesting factor is the difference between generations.

Taking Europe as a whole, it is currently the older generations who are the ‘doers’ – the ones making personal changes to support green action - while the younger generations, who have grown up within a greater culture of convenience and instant gratification, are vocal in support, but not taking as much personal action. This may be because, for post-millennials, many of the purchase and household decisions still lie with their parents. However, as key influencers of their parents’ shopping decisions, this group can still produce a significant impact. Additionally, the passion of younger generations to make green purchase decisions may well increase, given that just under half of post-millennials in Europe say that social media – a key channel for highly emotive, pro-environmental campaigns – is an important influencer of their purchase decisions.

But the story is not that straightforward. A large proportion of consumers are going through internal conflict. They are increasingly aware of the various environmental damage being done to our planet and are demanding that ‘something must happen’, but many are slow in changing their behavior if it requires a sacrifice of personal convenience - and this leaves them badly conflicted. They feel guilty for doing things they know are damaging the planet, but they want options that do not entail significant cost or expenditure of time and effort.

For example, people know that using their car for short trips is polluting but they find waiting for a bus or cycling too inconvenient. Or they want to use an eco-shampoo, but it must have the same foaming ability and easy application as their mass-market shampoo.

So how do manufacturers and retailers make sense of these conflicting signals?

How do they understand the size of this ‘conflicted consumer’ trend in their markets, and identify the core areas that will answer consumers’ growing eco-consciousness, while still delivering the products and performance those same consumers expect?

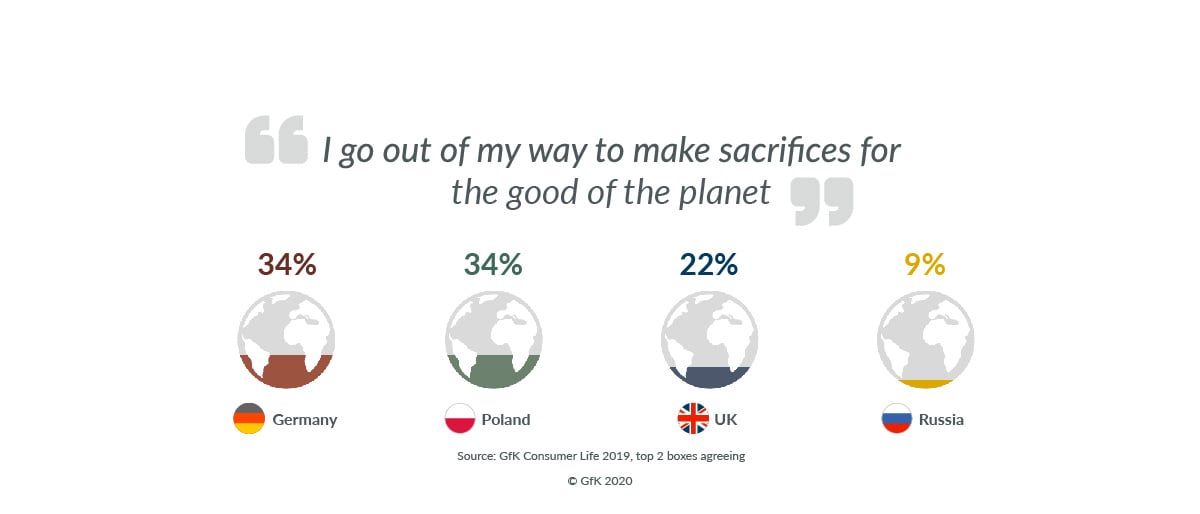

Taking four major EU countries as examples... Germany, Poland and UK have seen steady increases in recent years in the percentage of consumers saying they are making conscious changes to their lifestyles, in order to be more environmental.

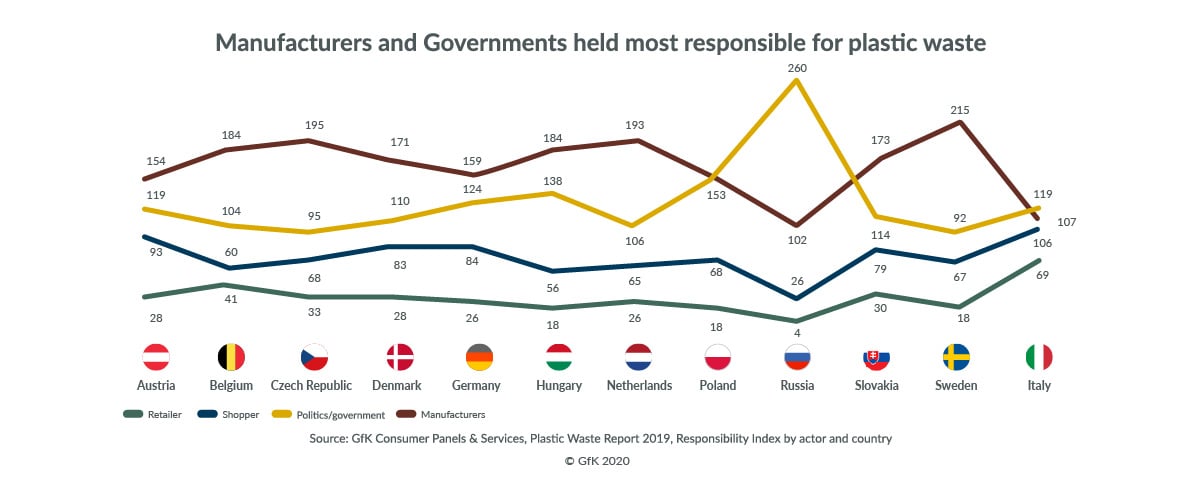

Russia is an exception, with a fall in the number making this claim over the last years. On the other hand, nearly half of Russians feel guilty when they do something non-environmentally friendly – an increase of five percentage point over the last 3 years and significantly higher than Germany, Poland, or UK. This apparently contradictory situation suggests a mindset in Russia, where people expect the Government, not individuals, to act on matters affecting the mass population (see also the chart below, “Manufacturers and Governments held most responsible for plastic waste” where Russia stands alone in seeing Government as most responsible).

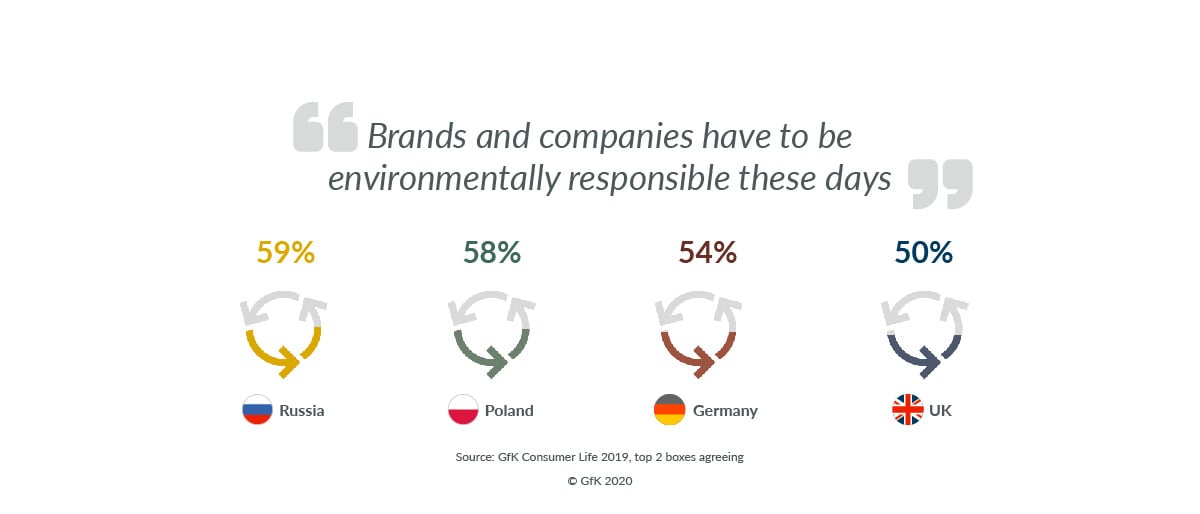

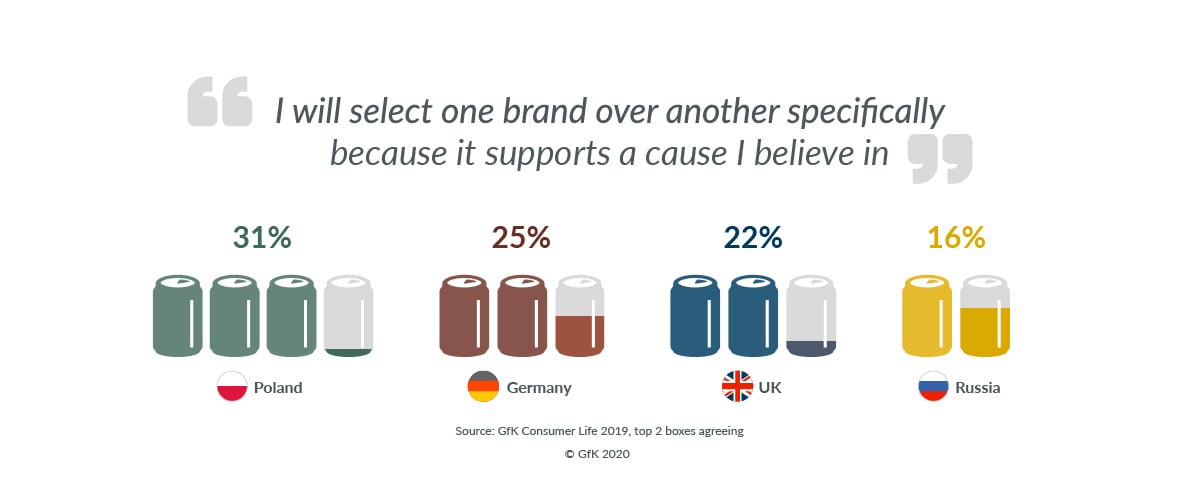

Alongside this personal focus, all four countries have shown an upward trend for consumers saying brands and companies must be environmentally responsible – now standing at a minimum of half of consumers in all four countries. And between a third and a quarter of people in Poland, Germany and UK say they will select one brand over another specifically because it supports a cause they believe in.

This immediately shows a distinction between consumer mindsets in Russia (the high percentage of environmentally aware consumers who expect companies to be environmentally responsible, but low numbers intending to take action at individual level), and Germany, Poland and UK (high numbers of environmentally aware consumers, as well as significant proportions expecting companies to be environmentally responsible, and taking personal action to support the environment). These different mindsets require tailored approaches around how brands shape and present their environmental actions to consumers, to trigger positive response.

When it comes to actual purchases at country level, we see a consistent trend of appliances with the top energy efficiency ratings out-selling the lower-rated appliances. While the growth of the top-rated appliances is slowing in some markets as they near saturation, these still make up the lion’s share of units bought. The exception is Russia, where A-rated appliances dominated in 2018.

A fundamental consideration for both manufacturers and retailers is the impact of educating consumers at key purchase decision points on the deeper green impact of a product, rather than just the paper credentials.

For example: consumers buying the larger 9kg-load washing machines with the best energy label ratings think they are being green. But if they are only half-filling those machines at each wash, they are actually burning more energy than if they had bought a smaller capacity machine and filled it full; even one that had a lower energy-efficiency rating. This comes down to consumers misunderstanding the current labeling, which gives the energy consumption of a product per kilogram or litre of capacity, rather than total energy consumed by running that appliance.

This need for deeper information is underscored in the new labeling being brought in by the EU in 2021, which requires that manufacturers provide greater transparency on the eco-friendliness of individual products, via QR codes that consumers can scan in-store or read online. Manufacturers and retailers can jump ahead of this curve by taking the initiative in presenting consumers with transparent information that can help them make correctly informed green purchase decisions.

We asked consumers across Europe to rank environmental challenges in order of priority. Plastic waste is far and away the #1 consumer concern - mentioned by well over half of people in every country we studied –followed by climate change or global warming (59%) and the loss of rain-forests (57%). So focusing on these are the immediate wins.

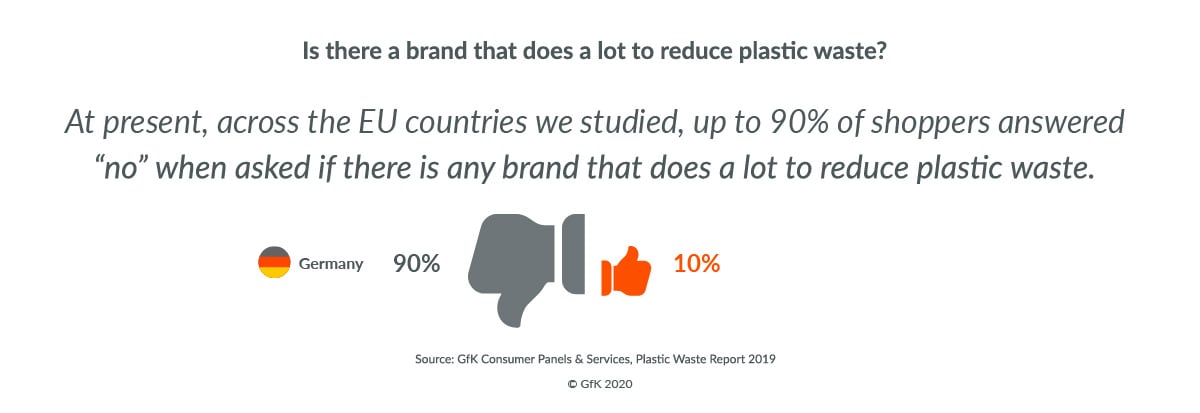

There is huge potential for a manufacturer or retailer to own the field in terms of consumer perception in this top-ranking area. At present, across the EU countries we studied, up to 90% of shoppers answered “no” when asked if there is any brand that does a lot to reduce plastic waste. Only around 10% answered “yes” – of which over half named a manufacturer brand, and a quarter named a retailer brand.

The prize for being THE brand that the majority of consumers associate with combating plastic waste is therefore wide open – both regionally and within specific countries.

And it is manufacturers that consumers are looking to the most, in their expectation of who should take the lead in combating this massive environmental problem. Across all the countries we studied, consumers named manufacturers and the Government as being most responsible for controlling and limiting plastic waste. Russia was the one country where consumers named the government as top of the list. In all other countries, it is manufacturers who consumers believe to be the most responsible of all.

While it is manufacturers, rather than retailers, whom consumers see as most responsible for controlling and limiting plastic waste, there are opportunities for both to win ‘hearts and minds’ of consumers by being seen to take effective action.

The FMCG industry has already made noticeable progress in this area, but industries such as Technical Consumer Goods (TCG) are falling behind.

For manufacturers, packaging and the product material are the golden keys to standing forward in consumers’ minds and winning positive recognition. The focus should be on reducing packaging to the minimum, using paper or cardboard wrappings instead of plastic, and using recycled and easily recyclable materials everywhere possible. A vital point is that our research shows that, when looking at product labels, consumers are hardly noticing the recyclable mark. Manufacturers who are switching to greener product materials therefore need to find much bolder ways to flag to consumers that they have made this change, and that their product is a green choice because it is easily recyclable. There are only seconds at the supermarket shelves to impact consumers’ choice between products – so the credentials must be highly visible, and convincing, to attract attention.

For retailers, the opportunity lies in being seen to be key influencers, encouraging manufacturers to switch to greener packaging and product materials by stocking and prioritising products that have clear green credentials. Alongside this, retailers can win approval in how they control the in-store environment, such as recycled paper bags, not plastic, for store carrier bags and loose groceries, and introducing ‘bring your own container’ schemes or ‘green sections’ and displays where shoppers can find all the greenest options in one place.

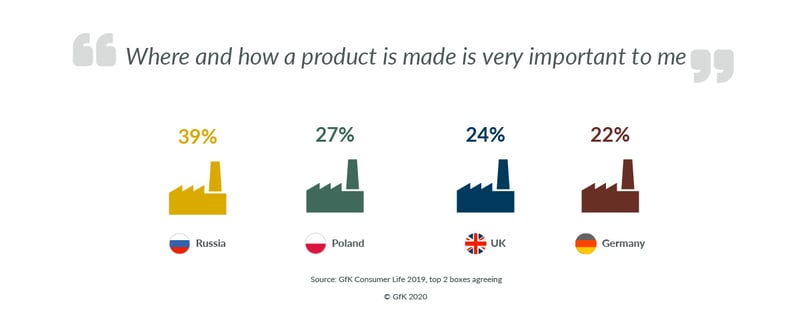

With rainforests being a major sponge and lock-down for CO2, they are vital in the battle against global warming. Brands can therefore maximize their positive resonance with consumers through actions that support rainforests, and therefore also battle climate change at the same time. Action taken in this area will additionally resonate with the notable segment of consumers in each country who state that where and how a product is made is very important to them.

Here again, we see opportunity for TCG manufacturers and retailers to learn from the progress already made by FMCG brands.

Manufacturers can focus on clear product labeling to highlight the eco-friendly ‘where and how’ their product is produced, or schemes such as brand donation to rainforest initiatives for every item sold. Additionally, manufacturers could develop products that are truly environmentally friendly, such as smaller appliances (in premium quality) that can be promoted as an honest energy-saver.

For retailers, the opportunity again lies in being the lead influencer and pivot of what products are presented to consumers, and the material of store carrier bags. By laying emphasis on the eco-friendly goods that they stock, or always presenting an eco-friendly option alongside ‘traditional’ options, retailers can position themselves in consumers’ minds as the champions for action against climate change and rainforest loss.

Significant (and increasing) proportions of the population across the world are placing importance on protecting our planet, with Europe showing the highest concentrations of eco-consciousness.

But many people are conflicted when it comes to changing their daily habits. They want green action to happen, but they are calling out for someone to help them rebalance the engrained high-convenience consumerism of our modern lives against the urgent need to be eco-conscious.

This is a golden opportunity for both manufacturers and retailers. They can win strong, emotional affinity with these conflicted consumers, by giving them easy ways to turn their current shopping guilt into feel-good shopping experiences. The FMCG industry has already made progress in this area, but industries including Technical Consumer Goods (TCG) are lagging behind. TCG brands that can offer consumers the information they need to take make green choices that are also easily adopted, or low sacrifice for consumers, are well set to win the hearts of this sizeable following.

The absolute “make or break” in all of this is that any eco claim must be authentic and transparent. Consumers are increasingly sensitive to ‘greenwashing’ and react strongly and vocally if they feel a brand has led them on with a cleverly worded claim aimed to trigger their personal values, but that turns out to have little real substance. Claims must be chosen with great care.

Significant (and increasing) proportions of the population across the world are placing importance on protecting our planet, with Europe showing the highest concentrations of eco-consciousness. But many people are conflicted when it comes to changing their daily habits. They want green action to happen, but they are calling out for someone to help them rebalance the engrained high-convenience consumerism of our modern lives against the urgent need to be eco-conscious.

This is a golden opportunity for both manufacturers and retailers. They can win strong, emotional affinity with these conflicted consumers, by offering them easy ways to turn their current shopping guilt into feel-good shopping experiences. The FMCG industry has already made progress in this area, but industries including Technical Consumer Goods (TCG) are lagging behind.

Our article shows data from four major EU countries - Germany, Poland, the UK and Russia – looking at the similarities and differences in consumer mindsets, together with the top five environmental challenges named by consumers across Europe. From this, we highlight specific areas of opportunity for manufacturers and retailers.