↓ Get all the data with the Black Friday infographic

↓ Download this article (PDF)

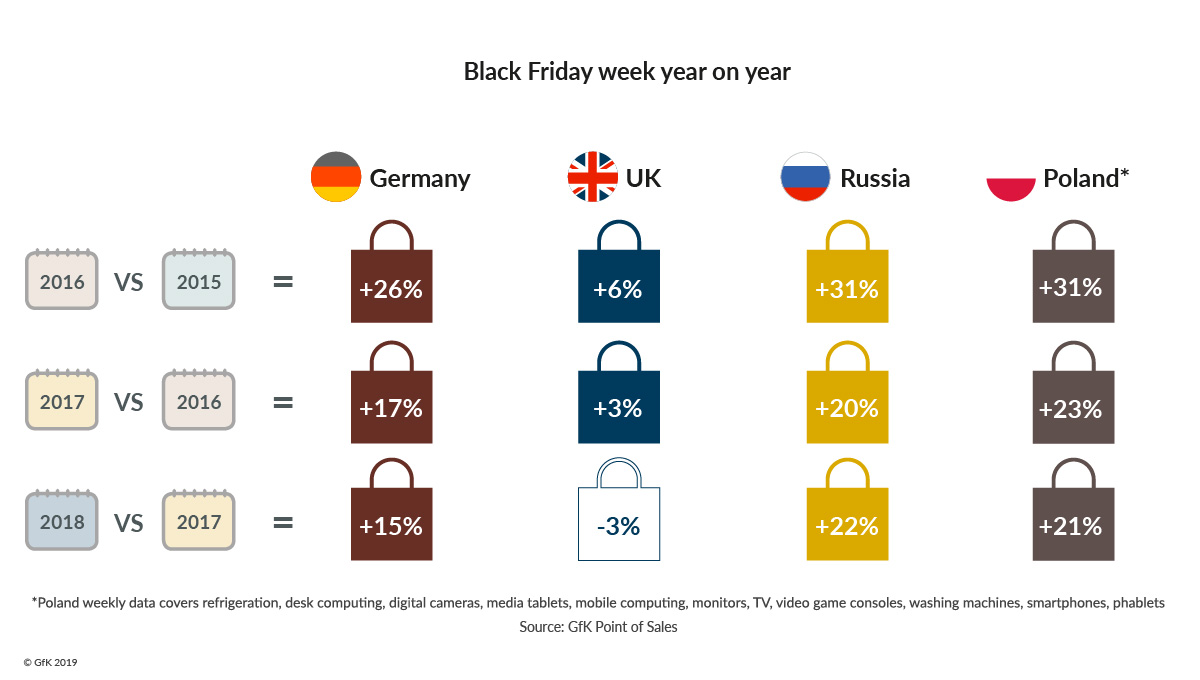

Black Friday is embedded in the retail calendar across Europe. It continues to grow strongly across many of our monitored countries, with only Great Britain, one of the earliest European adopters of the event, showing negative value growth in 2018, this coming after several years of growth.

In both volume and value Black Friday has become bigger than the traditional peak trading periods - including Christmas, the January sales, or Russia’s Gender holidays. Even in Poland, where Black Friday only recently became more mainstream, it is now snapping at the heels of Christmas week for sales.

.jpg?width=768&height=436&name=GfK_Black_Friday_Market_data_Christmas_versus_Black_friday_Mobile%20(Static).jpg)

This year, Black Friday could well be a whopper thanks to the timing of the event. It falls on the latest possible date, 29th November – aligning it with pay days and being only three and a half weeks before 25th December. But consumers are not jumping at just any so-called offer. Across Europe, shoppers are focused on value for money and are prepared to look around to find it.

Price and value for money are the no.1 factor for many people

Source: GfK Consumer Life 2019

Source: GfK Consumer Life 2019

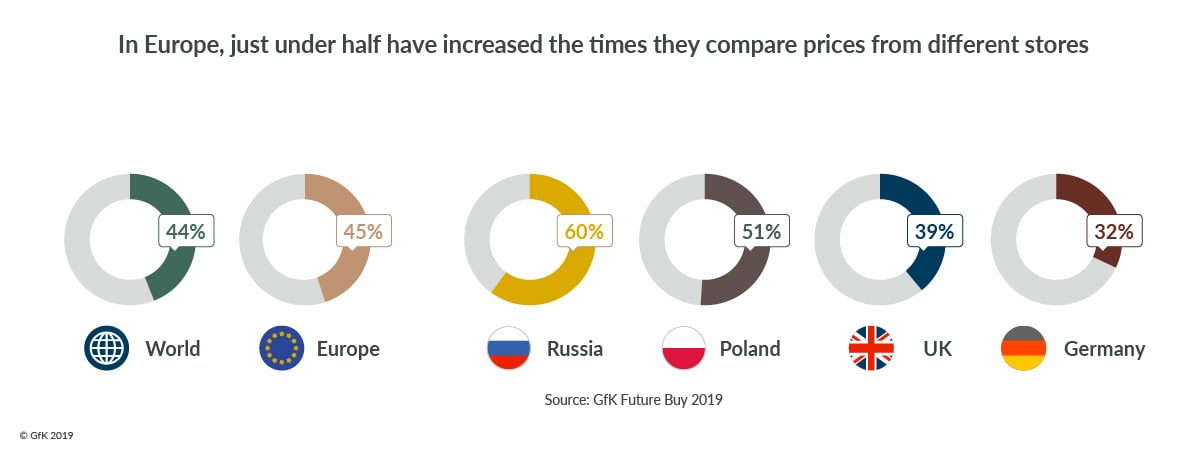

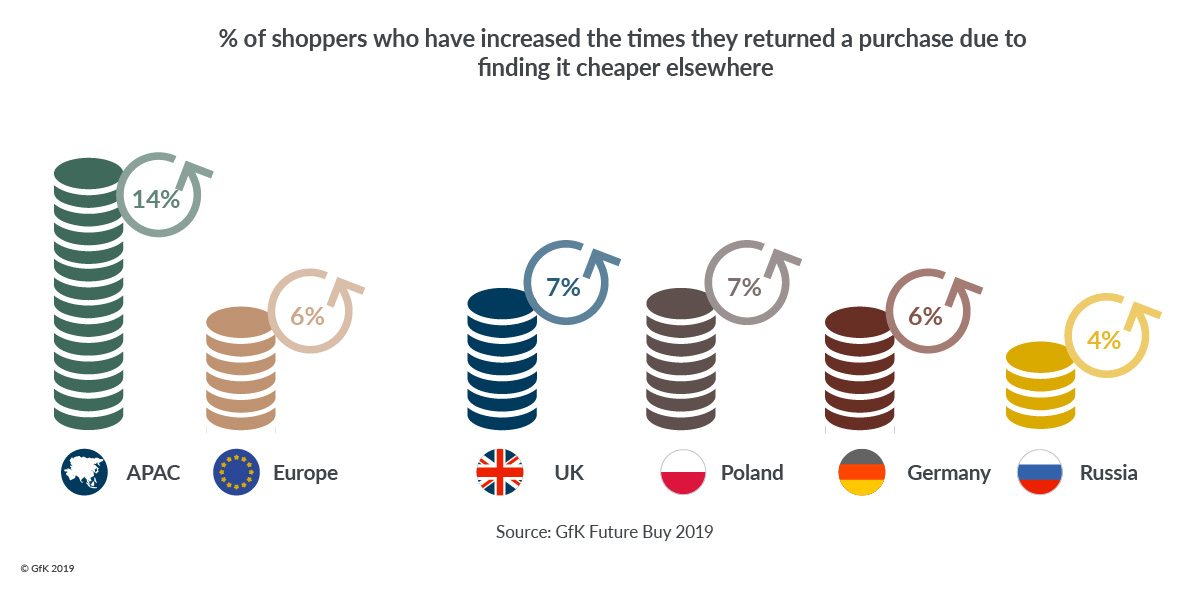

In fact, across Europe, 45% say they are comparing prices from different stores more often than they were a year ago – rising to 51% in Poland and 60% in Russia. The battle for price doesn’t end after the purchase is made; interestingly 6% of people across Europe say they have increased the number of times they have returned a product after purchase because they found it cheaper elsewhere.

Given the media focus last year on how ‘genuine’ some Black Friday deals really are, we foresee an increasing trend of consumers researching and checking deals this year. So how can manufacturers and retailers meet this consumer demand and still keep the event profitable?

Black Friday started with the perception of a bargain-basement event, with manufacturers and retailers in some cases risking their profit margins due to sweeping discounts. The pain of this intensified thanks to Black Friday falling in the final, ‘golden quarter’ of the year when businesses are pushing to make their year-end figures and historically rely on high levels of profitable consumer spending.

As Black Friday grew in terms of sales volume and value, it was quickly realized this early approach was not sustainable. In markets where Black Friday rivals, or has overtaken, Christmas spending, manufacturers and retailers are unable to sustain discounts across their range and still deliver a profitable ‘golden quarter’. Instead, we are seeing a change in approach in ‘mature’ Black Friday markets, with manufacturers and retailers curating their offers more strategically.

We now see fewer items on offer, and many promotions aimed at encouraging consumers to ‘trade up’ to buying a higher specification or more aspirational model than they may have purchased otherwise.

And this isn’t only a profit-driven strategy. A major challenge of Black Friday for shoppers is the bewildering array of offers. It’s like walking through a market with traders screaming every offer they have at you, without any regard to your needs or purchase intentions. By focusing offers on a smaller number of products, manufacturers and retailers are trying to reduce some of that noise, thereby helping consumers to navigate a crowded environment.

The big question is how well does this strategy cater to consumer needs? Do people approach Black Friday with a fixed shopping list, or are they open to the feel-good factor of upgrading their intended purchase, or indulging in impulse buying when they see a deal?

Without question, consumers across Europe love the feeling of getting a bargain. Added to this, significant proportions of shoppers say it’s “important to indulge or pamper myself on a regular basis” or that they “prefer to own fewer but higher quality items” or “only buy from trusted brands”. Combine these, and you’re on ideal ground to attract consumers who are ready to be tempted to use the sales to indulge in higher-end products.

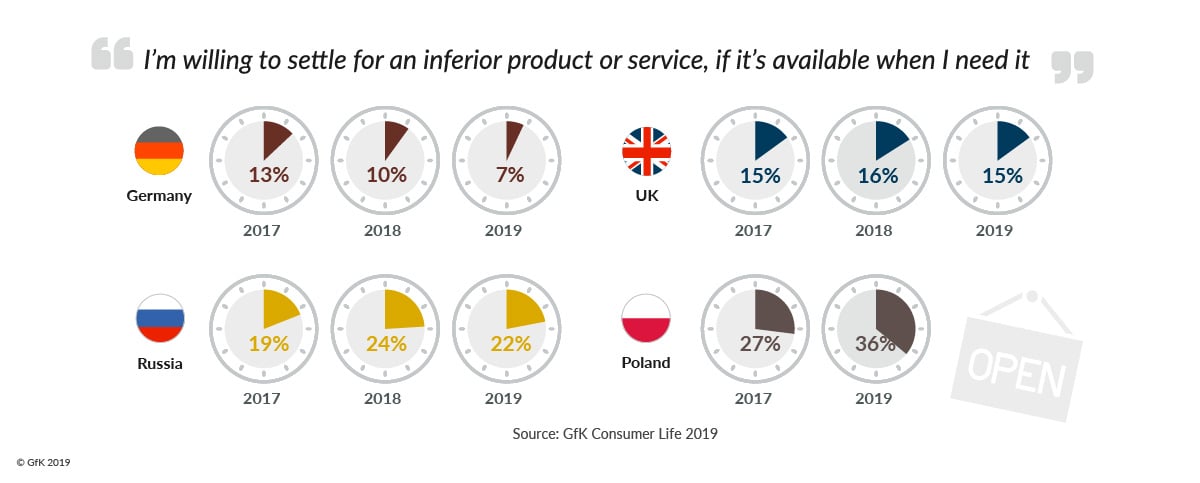

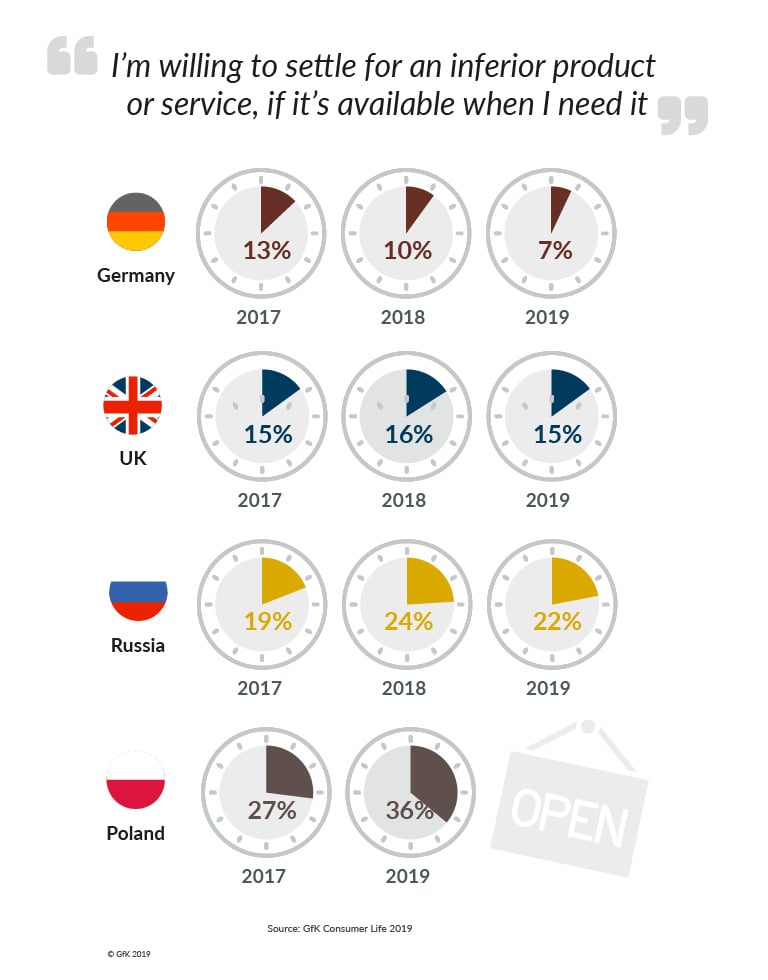

We should bear in mind there are some circumstances where consumers will trade down. These numbers are more prevalent in Poland and Russia – most likely driven by the trend for immediate gratification and getting a deal while an event is on, with choice perhaps more limited by lack of supply or availability. In sharp contrast to this, consumers in Germany show a clear decline in willingness to accept an inferior product or service, while the UK holds steady at just 15%.

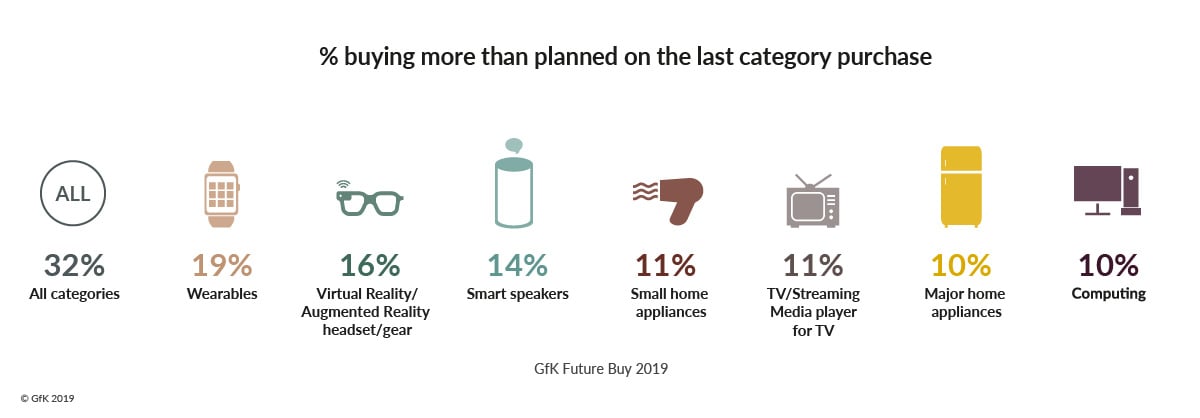

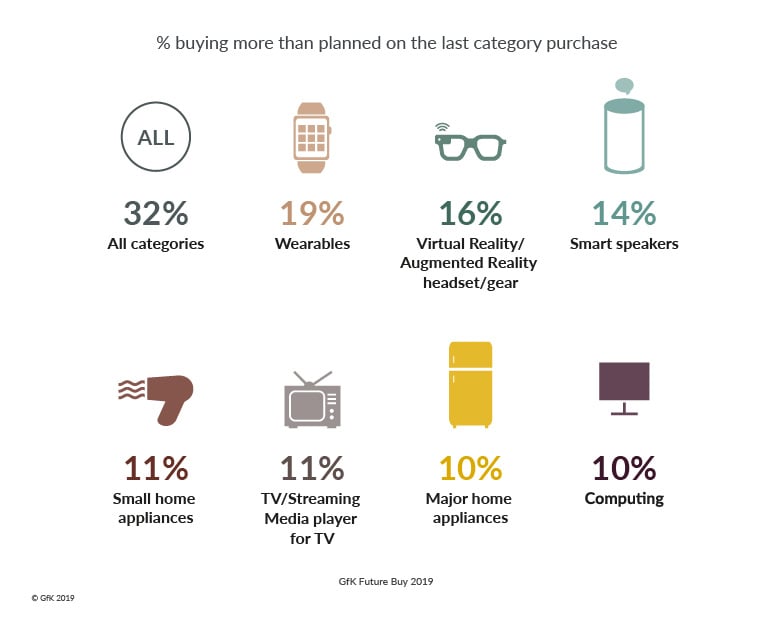

When it comes to impulse buying, there is clearly scope to encourage this. Already, a third of people in Europe say they bought more than they originally planned during the last purchase they made in the Tech & Durables sector. The top three areas for this impulse buying are wearable technology (19%), virtual or augmented reality gear (16%) and smart speakers (14%).

There are some interesting country peaks within this too… Germany is particularly open to impulse buying when shopping for virtual or augmented reality gear – with 31% buying more than originally planned. In Poland, there is more temptation for small home appliances (23% buying more than originally planned), and in the UK it’s wearables (20%).

Clearly, then, the opportunity is there in terms of consumers’ overarching attitudes towards shopping - but what about the hard sales data for Black Friday itself?

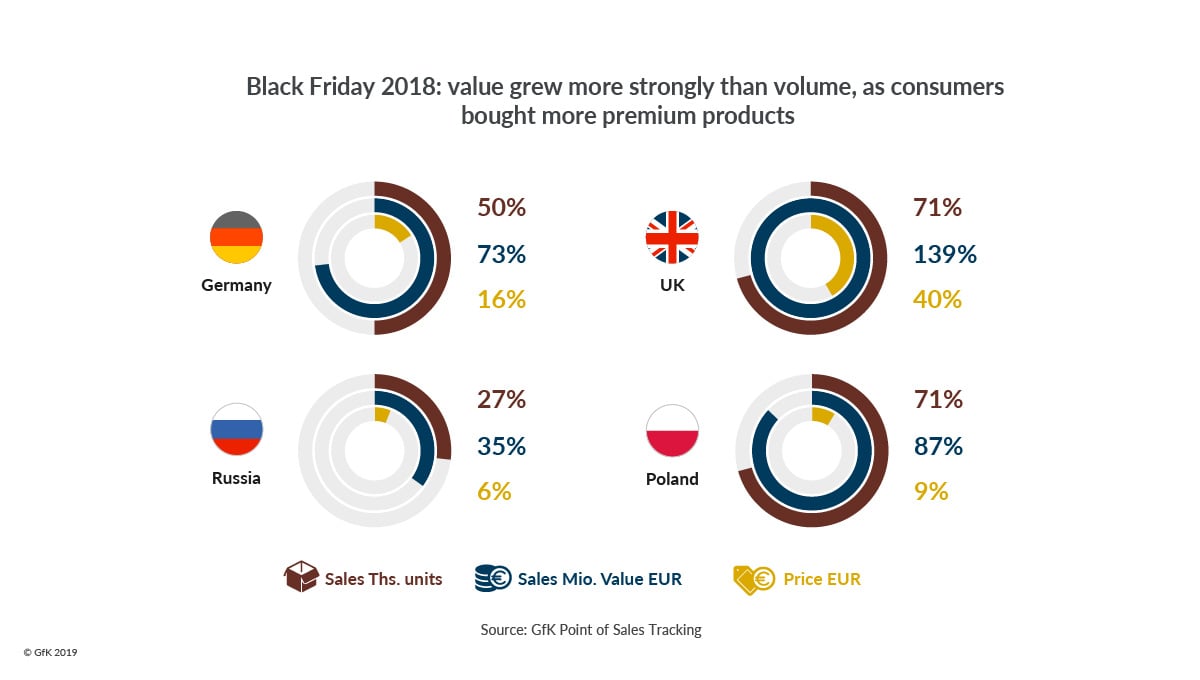

Our data shows how the strategy of premiumization for Black Friday offers is working across many categories. In 2018, average selling price increases were evident across Europe, with sale value growth outstripping volume. Put simply, consumers bought more premium products during Black Friday week when compared to an average week. This was particularly evident in Great Britain and France. Even in countries such as Russia, with high inflation rates, the price growth for Black Friday outstrips inflation.

In Germany 2018, consumers increasingly used Black Friday to get “more for less” – so more premium products, more features, more brands – for less money.

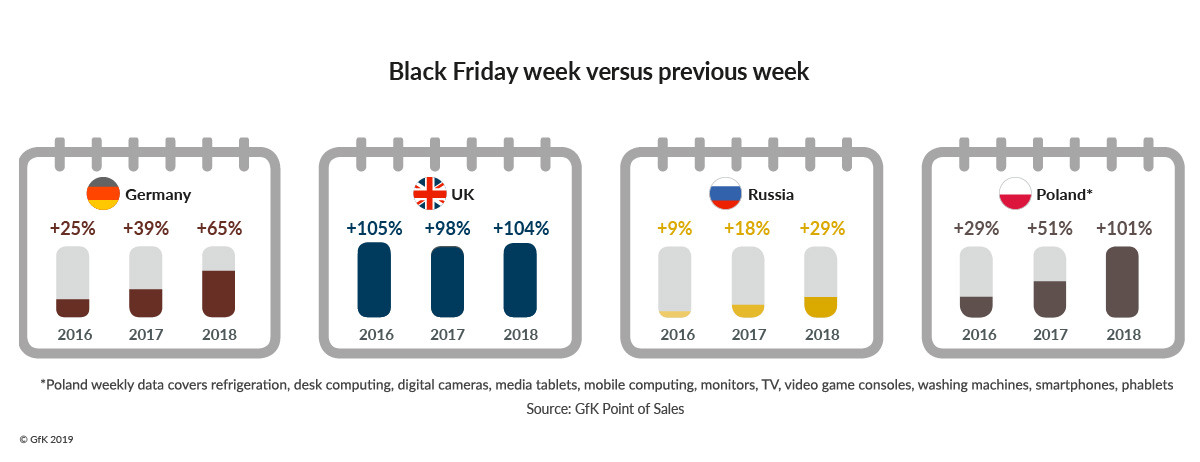

Retail sales figures for the Tech and Durable categories, therefore, went up even more dynamically in value (+65% versus the previous week) than they did in volume (+45% vs. previous week). Key categories like smartphone and TV showed the highest growth in value, while loudspeakers and mini-speakers were in high demand, showing dynamic growth rates of +174% and +155% respectively, compared to previous week.

Overall, we saw a clear trend towards premium products, indicated by an average price of 178€ during Black Friday week, compared to 159€ the week before. Interestingly, the sales share of models discounted by 15% or more during Black Friday is lower in Germany than in other European countries – so, despite double-digit growth rates of value, volume and average price, there is still a lot of growth potential for German retailers.

In Great Britain, the 2018 data shows several major product categories reflecting the premiumization effect, with consumers capitalizing on the extra money that can be saved at the higher price points.

Ultra-high definition TV saw an increase in value share of total TV sales from 80% two weeks before Black Friday to 84% in Black Friday week itself. This was particularly noticeable when looking at online sales, where 89% of TVs sold were UHD, an uplift of 11% from two weeks before. This was driven by a lift in large screen sizes. Sales of Tablet PCs at a price of £250+ increased their value share of the market from 62% the week before Black Friday to 66% in Black Friday week itself. Similarly, £100+ Headphones increased from 63% to 70%. In the appliance sector, handstick style vacuums grew their share of the market from 53% to 58%.

While the market is flooded with promotions at the full range of price points, and like-for-like price declines can be very strong, it’s clear that many of the most important categories are benefitting from a shift to the higher end during the Black Friday period.

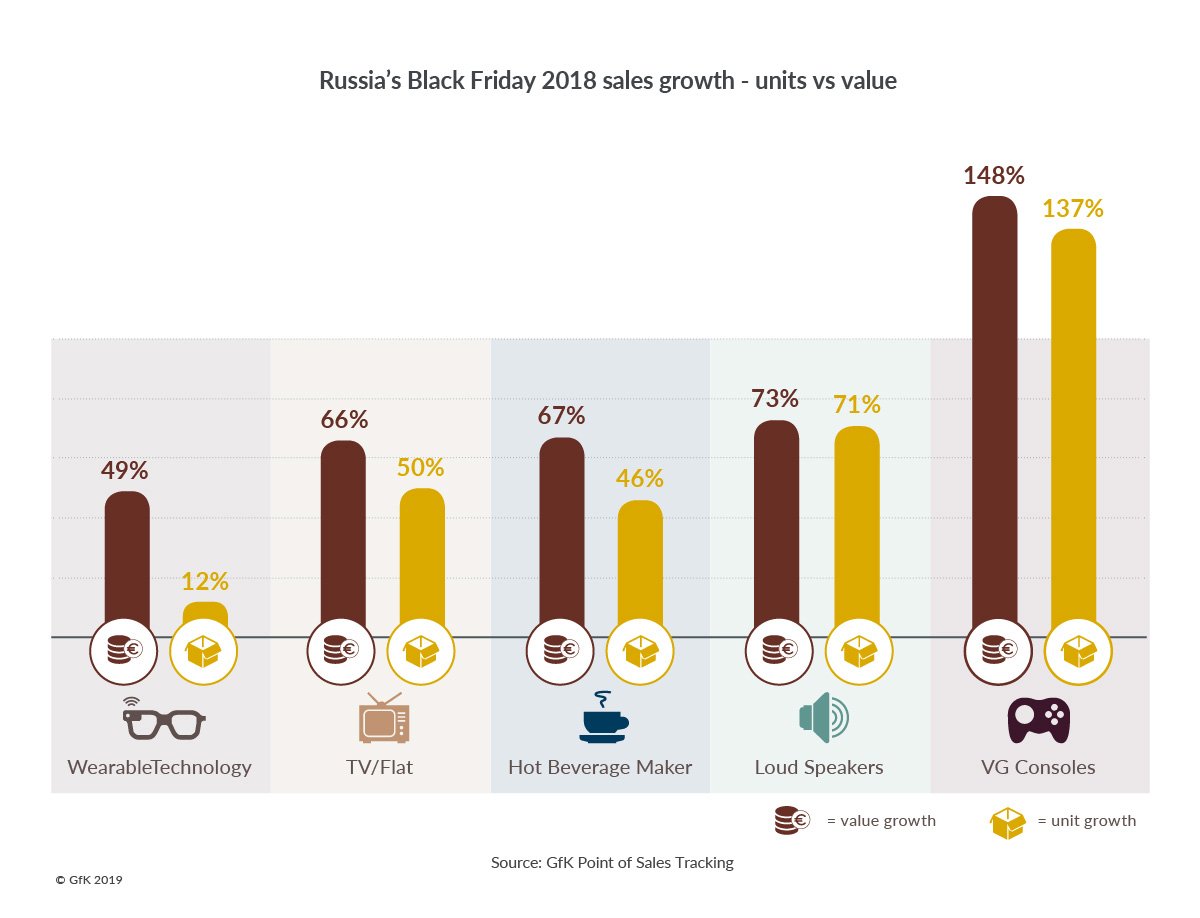

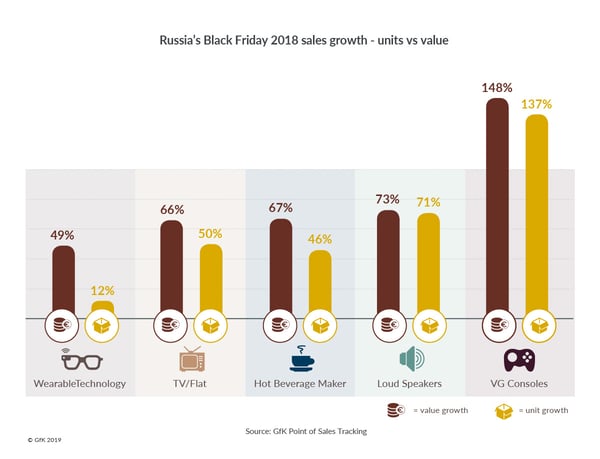

In Russia, Black Friday performance last year was driven by promotions on premium, technically equipped products. The five product categories driving the highest growth during Black Friday week (compared to the week before), included TV, loudspeakers, hot beverage makers, video game consoles, and wearable technology.

As an example, large screen TVs (55”+) had sales value growth of 94%, while UHD TVs demonstrated growth of 98% (Black Friday week compared to the week before), compared to the 66% overall growth of TVs, and driving the premium prices classes. In other categories, the growth of premium was significant as well. For example, the higher priced segment of 30K+ Rubles for wearables demonstrated growth of 269% in value compared to 49% growth of the total category.

Significantly, in Russia consumers prefer to buy several products in one place – which led to a lower growth in online sales (+27%) compared to offline (+30%) during Black Friday week last year.

In Poland, based on the product groups monitored weekly, we see that Black Friday is growing year by year. Thanks to this dynamic in 2018, the sales in Black Friday week were double that of the week before. It means that Black Friday development is following a similar pattern to that seen in earlier years in Great Britain. For some product groups, such as TV, Black Friday has become more important than each of the last two weeks of the year.

Poland is also witnessing consumers being willing to upgrade their purchases. In Black Friday week close to 30% of all spending on TV went to the larger screen sizes (60” plus). This is 5% higher than the week preceding Christmas. The same interest in premium products can be observed in refrigeration, with Black Friday sales of side-by-side or American style fridge freezers exceeding 12% in value share.

Like Russia, Poland also sees the share of internet sales actually decreasing during Black Friday week, compared to offline sales. This is due to the strong promotional activity of click and mortar retailers, aiming at attracting consumers to the stores, and thereby befitting from their presence both online and offline.

Stirred up by media stories around the validity of Black Friday deals, consumers are becoming more skeptical than in previous years. However, with the pressure to buy gifts and the observed increase in consumer wanting fast gratification, this is unlikely to prevent significant numbers of people taking up some of the deals on offer.

More important is the sheer volume of “noise” fired at consumers in the build up to, and on, Black Friday. With different retailers and manufacturers offering different deals on different days, it becomes near impossible for consumers to robustly search the full selection and know they are getting the best offer. People are crying out for a bit less choice!

Source: GfK Consumer Life 2019

Source: GfK Future Buy 2019

This is no bad thing, in that the calendar had been pretty fixed for a number of years. We can see from the success of these events that consumers do respond strongly to them, and are hungry for a deal. There will always be a cannibalization effect, and this is what we’ve seen with Black Friday in terms of the impact on traditional Christmas shopping.

The future success of Black Friday will increasingly depend on delivering reassurance and clarity to consumers; turning the current bombardment into something trusted and beneficial to them. The holy grail of any retailing is offering the right product at the right price in the right place at the right time. This is equally applicable during Black Friday with the amount of activity in the market. The more retailers can offer personalized and curated ranges, tailored to the specific consumers’ needs at that time, the more they will succeed. Combine this with trust around pricing and promotional management, and it’s a winning formula.

To successfully do all of this, manufacturers and retailers alike need data combining market sales trends, insights on consumer shopping attitudes and demographic differences, geographical hotspots of potential spending, and more.

**The thinking in this article is based on our combined Consumer Insights data (Consumer Life and Future Buy) and Point of Sales Tracking.

↓ Get all the data with the Black Friday infographic

↓ Download this article (PDF)

In Germany 2018, consumers increasingly used Black Friday to get “more for less” – so more premium products, more features, more brands – for less money.

Retail sales figures for the Tech and Durable categories therefore went up even more dynamically in value (+65% versus the previous week) than they did in volume (+45% vs. previous week). Key categories like smartphone and TV showed the highest growth in value, while loudspeakers and mini-speakers were in high demand, showing dynamic growth rates of +174% and +155% respectively, compared to previous week.

Overall, we saw a clear trend towards premium products, indicated by an average price of 178€ during Black Friday week, compared to 159€ the week before. Interestingly, the sales share of models discounted by 15% or more during Black Friday is lower in Germany than in other European countries – so, despite double-digit growth rates of value, volume and average price, there is still a lot of growth potential for German retailers.

In Great Britain, the 2018 data shows several major product categories reflecting the premiumization effect, with consumers capitalizing on the extra money that can be saved at the higher price points.

Ultra-high-definition TV saw an increase in value share of total TV sales from 80% two weeks before Black Friday to 84% in Black Friday week itself. This was particularly noticeable when looking at online sales, where 89% of TVs sold were UHD, an uplift of 11% from two weeks before. This was driven by a lift in large screen sizes. Sales of Tablet PCs at a price of £250+ increased their value share of the market from 62% the week before Black Friday to 66% in Black Friday week itself. Similarly, £100+ Headphones increased from 63% to 70%. In the appliance sector, handstick style vacuums grew their share of the market from 53% to 58%.

While the market is flooded with promotions at the full range of price points, and like-for-like price declines can be very strong, it’s clear that many of the most important categories are benefitting from a shift to the higher end during the Black Friday period.

In Russia, Black Friday performance last year was driven by promotions on premium, technically equipped products. The five product categories driving the highest growth during Black Friday week (compared to the week before), included TV, loudspeakers, hot beverage makers, video game consoles, and wearable technology. As an example, large screen TVs (55”+) had sales value growth of 94%, while UHD TVs demonstrated growth of 98% (Black Friday week compared to the week before), compared to the 66% overall growth of TVs, and driving the premium prices classes. In other categories, the growth of premium was significant as well. For example, the higher priced segment of 30K+ Rubles for wearables demonstrated growth of 269% in value compared to 49% growth of the total category.

As an example, large screen TVs (55”+) had sales value growth of 94%, while UHD TVs demonstrated growth of 98% (Black Friday week compared to the week before), compared to the 66% overall growth of TVs, and driving the premium prices classes. In other categories, the growth of premium was significant as well. For example, the higher priced segment of 30K+ Rubles for wearables demonstrated growth of 269% in value compared to 49% growth of the total category.

Significantly, in Russia consumers prefer to buy several products in one place – which led to a lower growth in online sales (+27%) compared to offline (+30%) during Black Friday week last year.

In Poland, based on the product groups monitored weekly, we see that Black Friday is growing year by year. Thanks to this dynamic in 2018, the sales in Black Friday week were double that of the week before. It means that Black Friday development is following a similar pattern to that seen in earlier years in Great Britain. For some product groups, such as TV, Black Friday has become more important than each of the last two weeks of the year.

Poland is also witnessing consumers being willing to upgrade their purchases. In Black Friday week close to 30% of all spending on TV went to the larger screen sizes (60” plus). This is 5% higher than the week preceding Christmas. The same interest in premium products can be observed in refrigeration, with Black Friday sales of side-by-side or American style fridge freezers exceeding 12% in value share.

Like Russia, Poland also sees the share of internet sales actually decreasing during Black Friday week, compared to offline sales. This is due to the strong promotional activity of click and mortar retailers, aiming at attracting consumers to the stores, and thereby befitting from their presence both online and offline.

Black Friday is embedded in the retail calendar across Europe. In both volume and value, it has become bigger than the traditional peak trading periods. But consumers are not jumping at any so called offer.

Across Europe, shoppers are focused on value for money, and 45% are comparing prices from different stores more often than they were a year ago. And a small but interesting segment have increased the number of times they have returned a product after purchase because they found it cheaper elsewhere.

Is Premiumization the answer for manufacturers and retailers – by allowing them to offer the discounts that consumers value, while still keeping the event profitable?

Without question, consumers across Europe love the feeling of getting a bargain. Added to this, significant proportions of shoppers say it’s “important to indulge or pamper myself on a regular basis” or that they “prefer to own fewer but higher quality items” – while impulse buying within Tech & Durables is present and can be encouraged. Combine these, and you have the perfect audience for Premiumization...

The more retailers can offer personalized and curated ranges, tailored to the specific consumers’ needs at that time, the more they will succeed. Integrate this with consumer trust around your pricing, and responsive promotional management, and it’s a winning formula.

Read our full article to see the differences across key European countries, and where the hurdles for manufacturers and retailers still lie.